Investors ought to consider the investment aims, challenges, and costs and fees of the mutual fund or ETF very carefully right before investing. Leveraged and Inverse ETFs might not be well suited for long-phrase investors and may maximize exposure to volatility in the use of leverage, quick gross sales of securities, derivatives along with other advanced investment procedures.

The promise is barely accessible to recent consumers. Refunds will only be applied to the account charged and can be credited in close to four weeks of a sound request. No other costs or bills and no current market losses is going to be refunded. Other restrictions may use. Schwab reserves the correct to change or terminate the promise Anytime.

Income is also a lousy investment to get a Roth IRA as it’s very likely to drop benefit as time passes because of inflation. Municipal bonds must also be prevented because their tax edge isn’t needed within a tax-advantaged account.

If you take out earnings early, however, you can be strike with taxes to the gains in addition to a reward penalty of ten percent on the earnings. Even so, certain employs — like for capable instructional bills — can assist you stay away from the reward penalty, though not the revenue taxes.

Typically, you’ll wish to allocate a lot more on the equity percentage of your portfolio to the largest asset courses — such as, that large-cap fund or a complete inventory sector fund, and secondarily, a made marketplaces or international inventory fund — and less to smaller classes, like smaller- and mid-cap funds and emerging marketplaces.

If a immediate rollover isn’t a possibility, you could be issued a Look at which you’ll need to deposit directly into your new Roth account you. When this takes place, you have got sixty times to finish the transaction ahead of the total amount is taken into account taxable.

Sign on and we’ll deliver you Nerdy content articles with regards to the income subject areas that matter most for you together with other techniques that may help you get far more from your money.

In addition, it doesn’t hurt that these funds frequently come with low price ratios, that means you gained’t pay out a whole lot towards the fund’s administrators, so additional of your returns remain in your pocket.

Examining account guideBest checking accountsBest absolutely free checking accountsBest on line Check out accountsChecking account choices

If the earnings is higher than the assortment that relates to your situation over, a Roth IRA is worthy of contemplating. Recall, however, that your earnings should also stay under the website thresholds we included earlier for being eligible to add into a Roth IRA.

What are the tax Added benefits? Using this type of account, your contributions are not tax deductible—but your earnings improve tax-free, and withdrawals may be created tax-free just after 5 years, furnished that you are age fifty nine½ or more mature.

A further thing to consider may here be the frequency of investing action that can take put inside the account — and in the investments held while in the account.

Your age issues mainly because, on the whole, you need to consider extra possibility once you’re younger and after that taper down when you inch toward retirement. That doesn’t necessarily mean you shouldn’t invest in stocks in retirement — given currently’s existence spans, you’ll even now require that cash to final quite a few decades earlier age sixty seven, and that requires investment advancement — but Lots of individuals decide to dial it back again a bit so there’s a bigger set-profits allocation from which to consider distributions.

The investment strategies talked about in this article may not be ideal for everyone. Every investor really should assessment an investment tactic for his / her own unique scenario prior to making any investment final decision.

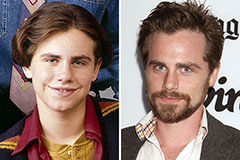

Rider Strong Then & Now!

Rider Strong Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!